All companies need MC Authority or ICC, if they operate as for hire, transport passengers in interstate commerce, or transport Federal regulated commodities. there are different types of authorities like Broker, for hire trucking, its depends on companies what kind of business they wanted to run.

Our expertise team can help you choose right authority for your business, and help you getting all the requirements to activate your MC authority.

How eTruckingSolution provides service for your trucking company.

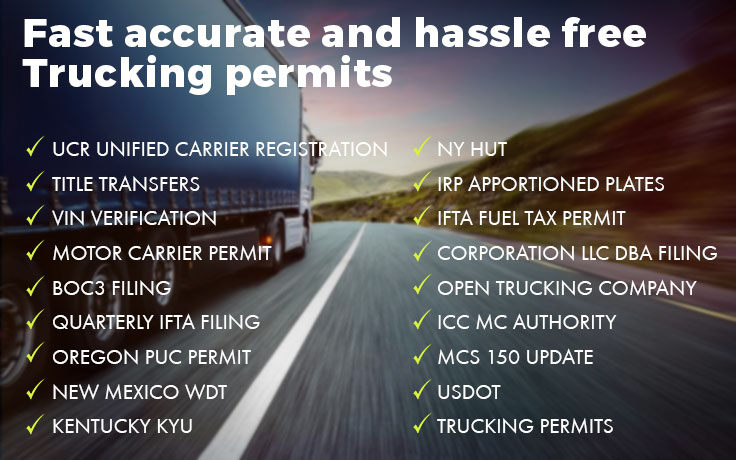

Our full truck and trailer management service covers these important functions: 1. Licensing, 2. Permitting, and 3. Fuel Tax (IFTA) Reporting to ensure your tractor trailers stay legally on the road and avoid costly fines.

Licensing & Permitting

eTruckingSolution will obtain your licenses and permits based on our extensive background in trucking compliance. We will provide support inn a way that benefits your trucking company financially.

eTruckingSolution will:

- Obtain initial permits for mileage, authority, International Fuel Tax Agreement (IFTA) and International Registration Plan (IRP)

- We have staff that monitors and completes your renewals for: IRP, IFTA, Heavy Vehicle Use Tax (HVUT), Mileage Permits (OR, NM, NY, GA, CA, MO, WA, IN, OK, AZ and/or KY), Unified Carrier Registration (UCR) and applicable Authority Permits.

- Complete IRP, IFTA, Mileage Tax, UCR and Authority Permit applications for additional vehicles added to your fleet.

- Communicate with states on your behalf whenever there are permit changes, such as address changes, return of permits, or cancellations.

- Review your IRP mileage information to ensure your vehicles are meeting the IRP requirements.

-

Provide recommendations for permitting needs for the following year.

Provide cost reports of total fuel, mileage, and authority permits. - Provide advisement on which base state you should use.

- Recommend best-practices to help you optimize your fleet efficiencies and tax liabilities.

- IFTA and Mileage Tax Reporting

To help you comply with your IFTA and Mileage Tax Reporting obligations, eTruckingSolution will:

- Collect and enter your driver trip reports, fuel receipts, and toll information into a specialized database. (We accept paper trip documents or electronic data transfer.)

- Conduct a proprietary audit covering 70+ edit checks, analyze data and correct errors to meet IFTA and IRP state compliance requirements.

- Identify and correct discrepancies when appropriate.

- Manage your monthly and quarterly mileage and fuel data.

- Complete and submit tax returns and disperse payments.

- Apply for ongoing fuel tax credits and refunds (as appropriate).

- Maintain trip reports, fuel receipts, and other documentation necessary to meet recordkeeping requirements. We retain this information at eTruckingSolution – Solutions in Tracy, California and purge according to regulatory timelines.

Generate Fuel and Mileage Reports, including:

- Monthly/Quarterly Fuel and Mileage Report (including all states)

- Monthly/Quarterly Unit Analysis Report

- Units with no activity